Renters Insurance in and around Ellwood City

Ellwood City renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your rented apartment is home. Since that is where you kick your feet up and rest, it can be a wise idea to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your hiking shoes, sports equipment, boots, etc., choosing the right coverage can help protect your belongings.

Ellwood City renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Protect Your Home Sweet Rental Home

Many renters don't realize that their landlord's insurance only covers the structure. Your valuables in your rented space include a wide variety of things like your desk, tool set, TV, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Mark Hasson has the efficiency and experience needed to help you examine your needs and help you keep your belongings protected.

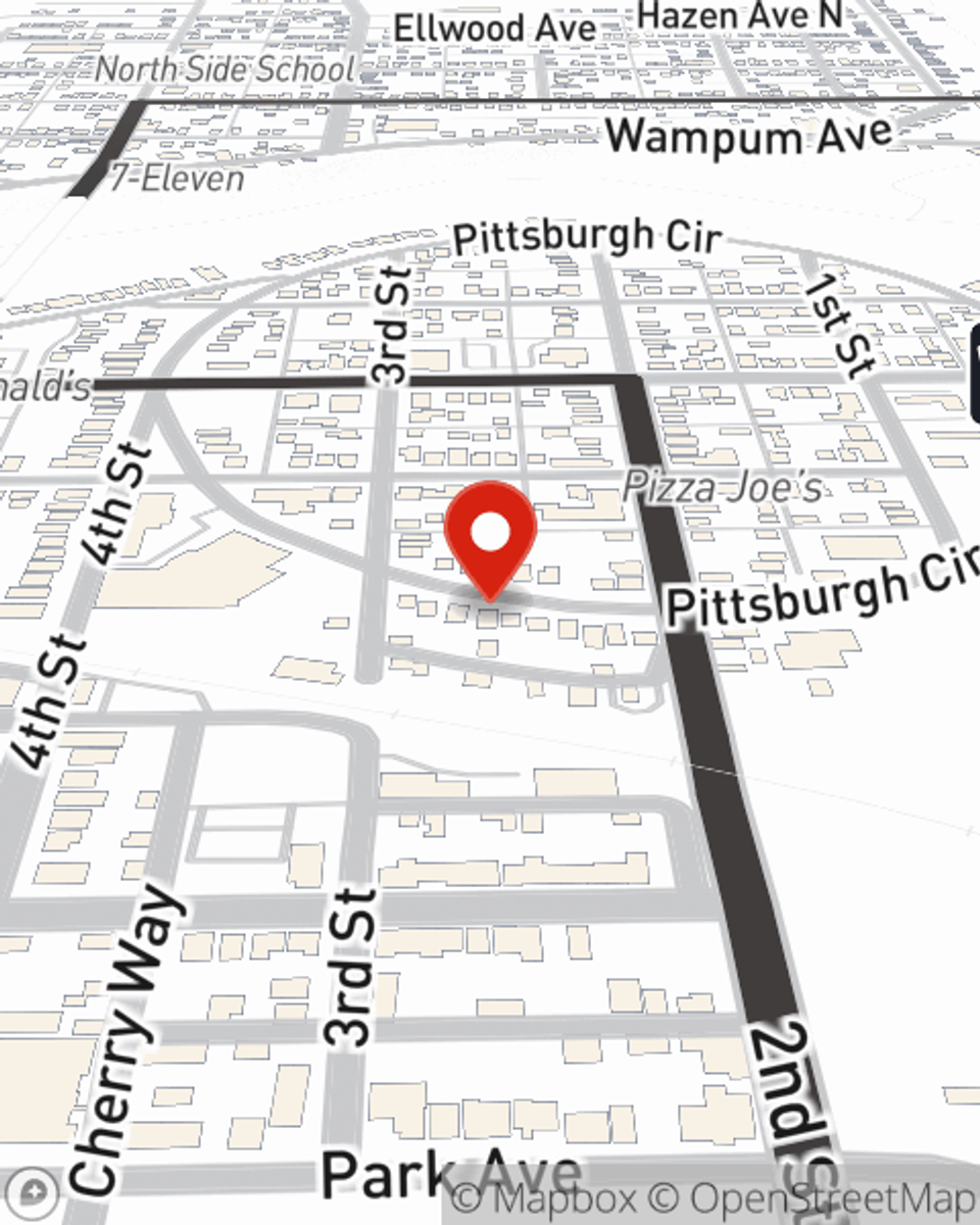

Renters of Ellwood City, call or email Mark Hasson's office to discover your specific options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Mark at (724) 758-3000 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Mark Hasson

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.